NOTE: This online shop is positioned as an E-catalog of OLEARN for you checking our products and latest price easily. You can select the items and sumbit your wish list when we are not online, you will get our response within 24 hours.

| QTY | Price |

|---|---|

| ≥ 1 | $USD 24.500 |

500 in stock.

QTY:

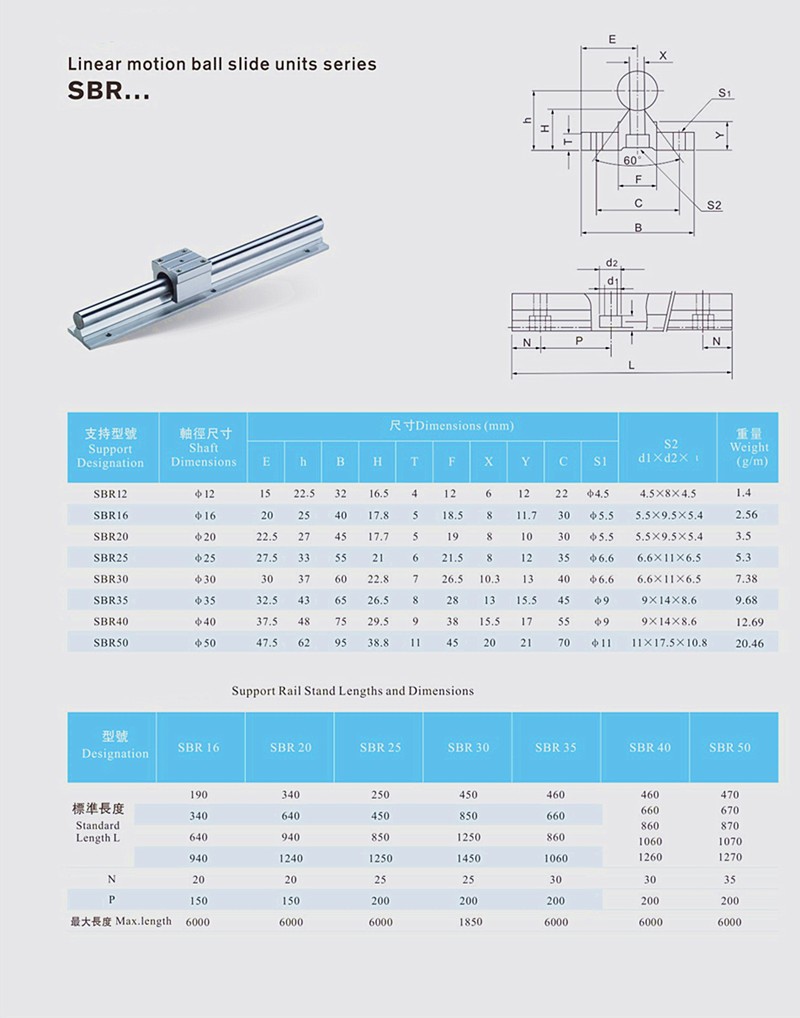

The SBR Supported Rods are used with SBR Linear motion ball slides. Supported smooth rod can be used over longer lengths without the need of additional supporting brackets, this allows for longer continuous lengths without a support block getting in the way. Supported smooth rod provides maximum rigidity and stiffness to the shaft throughout the whole stroke, and ensure the performance of the unit.

SBR linear guide is a linear shaft with aluminum bracket, which can achieve linear motion. The guide rail is composed of chrome-plated optical shaft and aluminum holder, which has high hardness, light weight, low cost and good bearing capacity.

Features:

1.Rail shaft diameters from 10mm to 50 mm;

2.Rail lengths to 6000 mm;

3.Carriage speeds up to 0.457 m/s;

4.Bearing materials available aluminum, and ball bearing;

5.Shaft materials available include chrome plated C45 steel, and chrome plated GCr15 steel;

6.Standard components include:

(1) Chrome plated steel shafting

(2) Aluminum alloy support rail

Details Informations For SBR Linear Rail

Customs

Olearn Tech. ships items globally and is not liable for any form of custom fees or taxes applicable on the items purchased from olearn technology.

There’s a possible chance that your country may charge import duties on the items ordered through us. We strongly suggest you get acknowledged about your local Customs policy before ordering from olearn technology.

If you have any questions about this issue, please submit a ticket

Customs Statement

olearn technology is not responsible for the collection or refund of any extra fees for customs or payment processes, thus, olearn technology cannot be held responsible for any package that does not make it through the local customs and is destroyed due to the item being illegal in the destination country. Customers are solely responsible for complying with their local laws. We can also not be held responsible for any import tax that may occur and it is the customers’ sole responsibility to pay this fee, if any.

By ordering on olearn tech, you agree to be solo responsible for all import taxes and duties that may be charged when your parcel passes through your local Customs. We advise you to find out about the local regulations prior to ordering from us. Olearn cannot give you advice or information about tax rates and customs charges in your country.

Should the buyer refuse the package due to import duties or taxes, the buyer takes full liability for all the costs involved in the process.

You are also liable for any import duties or taxes incurred during the return process.

Customs Statement in Brazil

According to Brazilian Customs policy, all orders sent to Brazil may receive a tax when passing through Customs, regardless of the product, type of freight chosen, declared value (Kindly note that a real value should be declared to the orders to Brazil.) or size of the packaging. The value of taxation is defined by the Federal Revenue Service of Brazil, with a single tax rate of 60% on import value (including value of merchandise, freight and insurance, if any). Extra fees (such as ICMS) can be applied according to the recipient's shipping address and chosen freight rate.

Customs fees are not collected at the time of purchase on olearn tech.. The valuation of the merchandise is prerogative of the Federal Revenue and the customer may request a revision of the tax, upon presentation of documentation proving the value paid for the product and filling the form in the agency or through the online system of the Post Office.

We remind you that olearn tech. is not responsible for the collection or refund of any extra fees for customs or payment processes such as import taxes, IOF and administrative fees. By purchasing at olearn tech. you agree to be solo responsible for payment of possible customs fees that may be charged upon arrival of the order to your country of destination.

FAQs about European Union VAT

Q: What's the European Union VAT?

R: Since July 1, 2021, Cross-border goods delivered to the destination located in the European Union (EU) are subject to VAT in accordance with the newly introduced VAT rules in the EU. The Value Added Tax, or VAT, in the European Union is a general, broadly based consumption tax assessed on the value added to goods and services. It is borne ultimately by the final consumer and is charged as a percentage of the price, including transportation fees and any other services included in the sale.

You can find more details regarding VAT on the European Union official website here: https://ec.europa.eu/taxation_customs/business/vat/eu-consumers_en

https://ec.europa.eu/taxation_customs/business/vat/what-is-vat_en

Q: What is the VAT rate?

R:The VAT rate varies depending upon the type of commodity purchased in the final destination country/place. It is the rate that EU countries have to apply to all non-exempt goods and services. It must be no less than 15% and some countries offer a reduced rate applicable to certain types of commodities. It is often levied based on the price (considering both goods and shipping fees) at the applicable VAT rate.

You may find more details about the applicable VAT rate here:

https://ec.europa.eu/taxation_customs/business/vat/eu-vat-rules-topic/vat-rates_en https://ec.europa.eu/taxation_customs/business/vat_en

https://ec.europa.eu/taxation_customs/tedb/vatSearchForm.html

Q: Is there a difference between VAT and customs duties? Could I pay only one of them?

R: VAT and customs duty are different types of taxes.

VAT is a consumption tax you pay when you purchase goods in a country. Custom duty refers to the tax imposed on goods when they are transported across international borders. In addition to VAT, it is often required from the consumer to pay customs duty on imported goods. Unlike VAT, the rate of duty is variable and depends on the nature of the goods being imported, and where they are being imported from.