NOTE: This online shop is positioned as an E-catalog of OLEARN for you checking our products and latest price easily. You can select the items and sumbit your wish list when we are not online, you will get our response within 24 hours.

| QTY | Price |

|---|---|

| ≥ 1 | $USD 2.000 |

| ≥ 50 | $USD 1.870 |

| ≥ 200 | $USD 1.740 |

250 in stock.

QTY:

A lead screw is a kind of mechanical linear actuator that converts rotational motion into linear motion. Its operation relies on the sliding of the screw shaft and the nut threads with no ball bearings between them. The screw shaft and the nut are directly moving against each other on a large contact area, so higher energy losses due to friction are produced. However, the designs of lead screw threads have evolved to minimize friction. The lead screws are a cost-effective alternative to ball screws in low power and light to medium-duty applications. Since they have poor efficiency, their use is not advisable for continuous power transmission. Unlike ball screws, they operate silently with no vibration and have a more compact size. They are typically used as a kinematic pair (linkage) and actuation and positioning in equipment such as lathe machines, scanners, recorders, wire bonders, and disk drive testers. They are used to transmit forces in testing machines, presses, and screw jacks.

The 3D printer Nut is made of POM material that is durable and low-noise, you can use it for a long time without being damaged. This kind of 3D printer is suit for T8 screw, easy to install, you’d better to make sure the type before ordering. As an important 3D printer accessory, this kind of nut could help the 3d printer work as usual, making your work more convenient. There are designed with different sizes for choosing, you can order according to our need, enough to meet your needs. This kind of nut could help to prolong the service time of your 3D printer, saving time and money for you.

NOTE: This Nut Block is CNC milling not moduling, if you want cheap moduling teype, just contact us.

About this Nut Block:

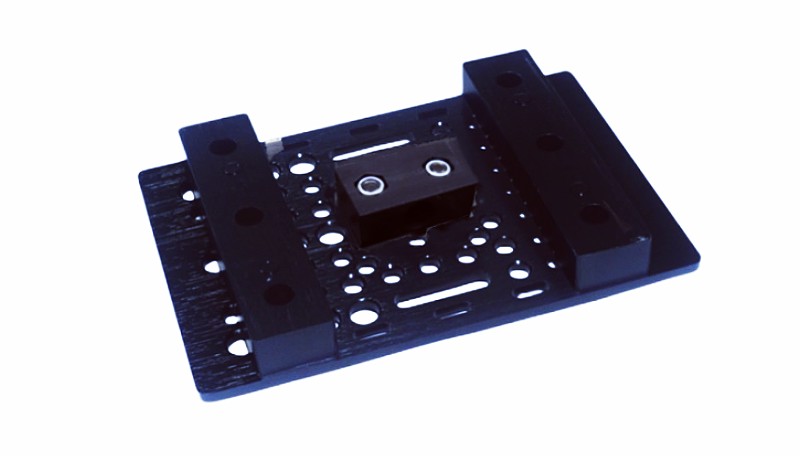

This 8mm Acme Nut Block is a great choice for many projects requiring lead screw linear motion. It serves more than one purpose in that it can be mounted to the bottom of a 3mm/1/8'' plate utilizing M5 nylon insert nuts and 15mm M5 low profile screws or can also be mounted directly to V-slot utilizing two channels with 15mm M5 low profile screws and two tee nuts. These mounting choices allow for a host of modular machine applications. You can mount this block along any length of V-Slot to create your linear motion.

Please Note: This is a standard non-adjustable version of the Nut Blocks and so cannot take out any play or backlash in the system. These style Nut Blocks are designed more for a system where higher precision and repeat-ability is not a necessity. If you are looking for a higher percision Nut Block please have a look at the Anti-Backlash Nut Block.

Tr8*8(p2) Metric Acme Tap

Pitch is 2mm

starts is 4

Lead is 8mm

Material: Delrin

Use in conjuntion with the 8mm Metric Lead Screw.

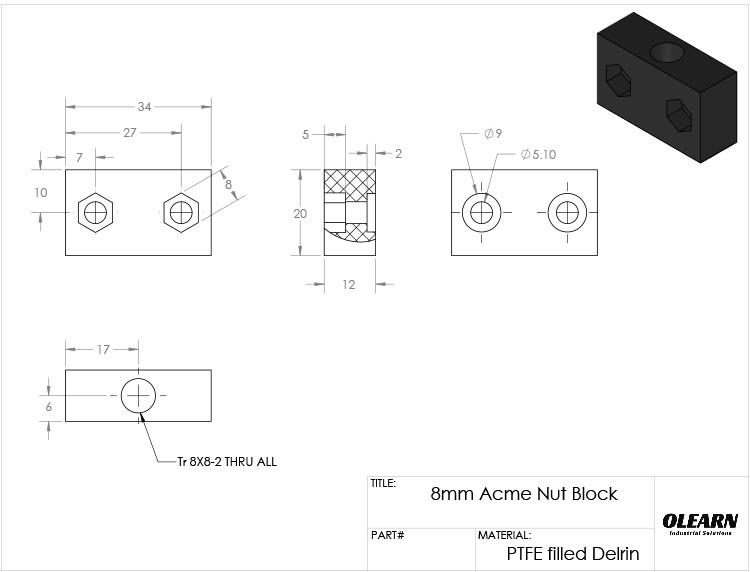

Dimension For This Nut Block

Customs

Olearn Tech. ships items globally and is not liable for any form of custom fees or taxes applicable on the items purchased from olearn technology.

There’s a possible chance that your country may charge import duties on the items ordered through us. We strongly suggest you get acknowledged about your local Customs policy before ordering from olearn technology.

If you have any questions about this issue, please submit a ticket

Customs Statement

olearn technology is not responsible for the collection or refund of any extra fees for customs or payment processes, thus, olearn technology cannot be held responsible for any package that does not make it through the local customs and is destroyed due to the item being illegal in the destination country. Customers are solely responsible for complying with their local laws. We can also not be held responsible for any import tax that may occur and it is the customers’ sole responsibility to pay this fee, if any.

By ordering on olearn tech, you agree to be solo responsible for all import taxes and duties that may be charged when your parcel passes through your local Customs. We advise you to find out about the local regulations prior to ordering from us. Olearn cannot give you advice or information about tax rates and customs charges in your country.

Should the buyer refuse the package due to import duties or taxes, the buyer takes full liability for all the costs involved in the process.

You are also liable for any import duties or taxes incurred during the return process.

Customs Statement in Brazil

According to Brazilian Customs policy, all orders sent to Brazil may receive a tax when passing through Customs, regardless of the product, type of freight chosen, declared value (Kindly note that a real value should be declared to the orders to Brazil.) or size of the packaging. The value of taxation is defined by the Federal Revenue Service of Brazil, with a single tax rate of 60% on import value (including value of merchandise, freight and insurance, if any). Extra fees (such as ICMS) can be applied according to the recipient's shipping address and chosen freight rate.

Customs fees are not collected at the time of purchase on olearn tech.. The valuation of the merchandise is prerogative of the Federal Revenue and the customer may request a revision of the tax, upon presentation of documentation proving the value paid for the product and filling the form in the agency or through the online system of the Post Office.

We remind you that olearn tech. is not responsible for the collection or refund of any extra fees for customs or payment processes such as import taxes, IOF and administrative fees. By purchasing at olearn tech. you agree to be solo responsible for payment of possible customs fees that may be charged upon arrival of the order to your country of destination.

FAQs about European Union VAT

Q: What's the European Union VAT?

R: Since July 1, 2021, Cross-border goods delivered to the destination located in the European Union (EU) are subject to VAT in accordance with the newly introduced VAT rules in the EU. The Value Added Tax, or VAT, in the European Union is a general, broadly based consumption tax assessed on the value added to goods and services. It is borne ultimately by the final consumer and is charged as a percentage of the price, including transportation fees and any other services included in the sale.

You can find more details regarding VAT on the European Union official website here: https://ec.europa.eu/taxation_customs/business/vat/eu-consumers_en

https://ec.europa.eu/taxation_customs/business/vat/what-is-vat_en

Q: What is the VAT rate?

R:The VAT rate varies depending upon the type of commodity purchased in the final destination country/place. It is the rate that EU countries have to apply to all non-exempt goods and services. It must be no less than 15% and some countries offer a reduced rate applicable to certain types of commodities. It is often levied based on the price (considering both goods and shipping fees) at the applicable VAT rate.

You may find more details about the applicable VAT rate here:

https://ec.europa.eu/taxation_customs/business/vat/eu-vat-rules-topic/vat-rates_en https://ec.europa.eu/taxation_customs/business/vat_en

https://ec.europa.eu/taxation_customs/tedb/vatSearchForm.html

Q: Is there a difference between VAT and customs duties? Could I pay only one of them?

R: VAT and customs duty are different types of taxes.

VAT is a consumption tax you pay when you purchase goods in a country. Custom duty refers to the tax imposed on goods when they are transported across international borders. In addition to VAT, it is often required from the consumer to pay customs duty on imported goods. Unlike VAT, the rate of duty is variable and depends on the nature of the goods being imported, and where they are being imported from.